As of May 8 2025, the Arbitrum DAO approved a proposal to invest 35 million ARB tokens into tokenized U.S. Treasuries through partnerships with Franklin Templeton, Spiko, and WisdomTree. This strategic allocation aims to diversify the DAO’s treasury holdings, traditionally dominated by crypto-native assets, by incorporating low-risk, yield-generating instruments.

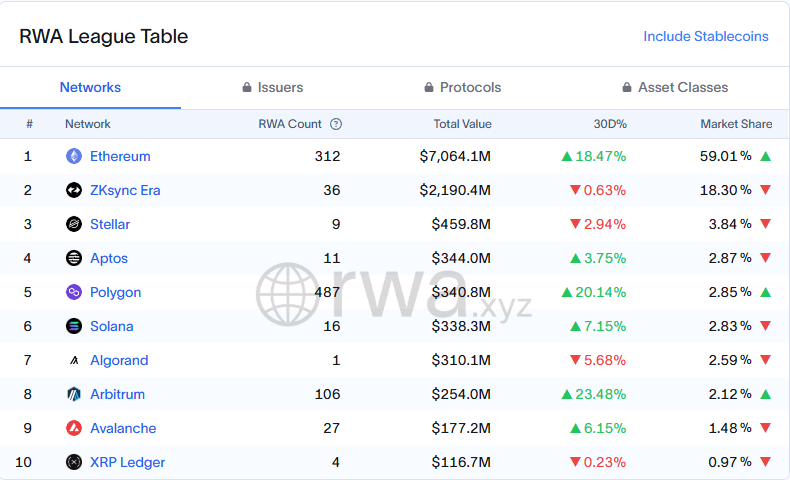

This is of particular interest due to the likely intended effect of the partnerships, being to form a stronger relationship to bring RWAs such as tokenized U.S. Treasuries to Arbitrum. As it currently stands, the majority of RWAs are deployed on Ethereum mainnet and not on L2s. Arbitrum was recently passed by Base by TVL, and has already been long superceded by Base by onchain volume. So far no EVM L2 or Solana has managed to take significant market share in RWAs, meaning the opportunity to challenge Ethereum mainnet to grow RWAs is still present.

Over $240 million in RWAs is currently held onchain via Arbitrum-based platforms, representing a 50x increase over the past year, the Arbitrum Foundation said. This is an achievement for Arbitrum, but overall $22.45B of RWAs exists onchain as per RWA.xyz analyics. This means that Arbitrum only has 1% market share, and this is likely something Arbitrum wants to grow in the future.

Whilst the short term benefits for the Arbitrum DAO include the yield generated from these RWAs, the long term picture is clear. Will the Arbitrum DAO manage to utilize its treasury and partnerships to bring more RWAs onchain and continue its growth trajectory? For those holding $ARB, there is significant opportunity for Arbitrum to capture RWA growth and generate revenue owned by the DAO, and potentially accrue fees and value back to the $ARB token. For now, this is yet to be seen but a good step in the right direction by the DAO.

RWAs have predominantly been deployed on Ethereum Mainnet, and Arbitrum sits in 8th place as of May 2025. However, it has also seen the most growth in 30 days inside the top 10 and there is an opportunity arising for Arbitrum to onboard RWA enterprises and position itself as an RWA chain. This is one sector that generally lacks onchain token activity the way AI or memes have been able to do, and there is an opportunity for many chains to take the lead in this narrative.

So far, it is not the case that investors can directly benefit from the growth of Arbitrum’s RWA value due to the majority of TVL being from the likes of Franklin Templeton and Blackrock BUIDL. What would be most interesting would be growth of Arbitrum’s RWAs from protocols that have strong value accrual to a token that is tradable and liquid on Arbitrum. For now, we are looking for such opportunities when they arise.

About Vestun

Vestun is a Swiss-regulated capital holding with a thesis-driven approach, primarily focused on digital assets and AI. We engage across public and private markets through syndication, incubation, and strategic alignment with institutional and corporate partners.